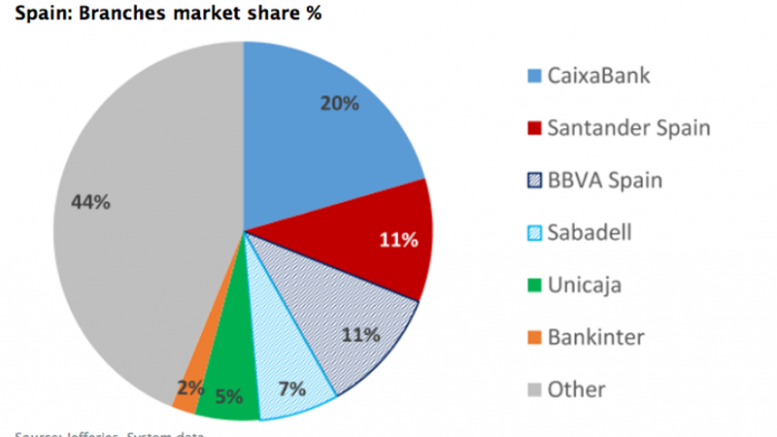

BBVA takes aim again at Sabadell

Jefferies | A press leak earlier this morning seems to have unveiled renewed merger talks between BBVA (Buy) and Sabadell (Restricted). We provide some food for thought and outputs under different scenarios. We can see the merits for such a deal from the vantage of BBVA, but we remain expectant on whether both parties can agree on sensible terms. Our baseline scenario suggests 3.5% EPS accretion on just 20bps CET1…

Read More