In the World

Central banks should reflect on monetary policy

J. L. Martínez Campuzano (Spanish Banking Association) | The BoJ has begun a period of reflection to try to answer the question of why expansionary monetary measures are not being reflected in higher inflation. I honestly believe that this is a reflection which other central banks should undertake. But, in the end, the easiest thing will always be to continue with more measures without a clear strategy of what their final objectives are.

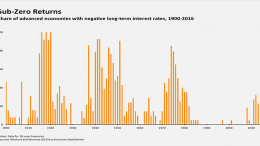

Financial repression

Why are interest rates so low? We have explained that the reason is the weak credit situation for financing investment.

BoJ, ECB and now BoE: anything is possible with economic policy

Fidelity | In line with expectations, the Bank of England’s monetary policy committe voted unanimously to cut interest rates – for the first time since 2009 – by 0.25%. It also announced a package of additional measures, such as an extension of the current quantative easing programme (including corporate bond purchases) and a new liquidity line (Term Funding Scheme).

The Odds On An Early Rate Hike

The outstanding labour market performance in the US has triggered widespread speculation of a Fed rate hike as early as September. Nonetheless, most new jobs are part-time, while the hourly wage increase lags well behind its pre-crisis pace.

Using all available instruments: does this ring a bell?

J. L. Martínez Campuzano (Spanish Banking Association) | Perhaps one of the most important conclusions of the G20 meeting held in China was the need for monetary and fiscal instruments to fuel demand. But also for reforms to adjust supply and increase growth potential. There is no doubt that every instrument of economic policy is needed in the fight against weak growth and low inflation.

What is the economic impact of the Rio Olympic Games?

CaixaBank | Everything is ready for the inauguration of the 2016 Olympic Games in Rio de Janeiro on Friday. This is the most important global sporting event and Brazil is the first South American country ever to have hosted the games. But what will the economic impact be for the country which is in recession?

My fault, my fault, my most grievous falt… but not that much

In an internal report, the IMF has confessed to errors linked to the bailouts in which it participated during the euro crisis, according to what Ambrose Evans-Prichard tells us. Just what the euro needed: explicit recognition, in black and white, that nothing could be done about the “infamy of competitive devaluation.”

Consumers Unlikely to Rescue China’s Sputtering Economy

Huang Zhilong via Caixin | Chinese policymakers have turned to domestic consumption as a new force to drive economic growth, as debt-heavy businesses and local governments face growing pressure to deleverage. But as the nation’s economic expansion and wage growth cool, it will be difficult to encourage ordinary people to increase spending if that means borrowing more.

What’s Wrong With Wall Street Which Keeps Breaking Records?

Wall Street’s ability to suprise the world with its strength seems boundless. While the stock markets in the emerging countries are sinking and the European bourses are almost stagnating, Wall Street’s indices have been breaking records since 2010, immune to bad news.