LONDON | Were the tide changing within the shaken frontiers of the European Monetary Union, austerity-driven core euro nations could do worse than open the European Investment Bank’s window to let some fresh capital aid in. Barclays analysts said Friday in a note to investors that using the EIB to complement budget constrictions would be a feasible option and the probability of this happening is growing: this time it is a major economy, that of Spain, the one destabilising the euro zone to the extent of threatening a real breakup.

Fuelled by the new governments in Madrid and Paris, comments by European politicians stressing the importance of growth in Europe are trending, in fact. Originally, EU president Herman Van Rompuy initiated a proposal to put an additional €10bn into the EIB. According to the German Frankfurter Allgemeine Zeitung, the European Commission is backing this proposal, as is German Chancellor Angela Merkel and president of the Eurogroup Jean-Claude Juncker.

Olli Rehn, economic and financial affairs vice president, mentioned it in a speech given at the Institute of European Studies in Brussels on 5 May:

“growth can be achieved through confidence, reforms and investment.”

But investor risk aversion is at all-high levels, reducing the already volatile scope for new projects. On the other hand,

“financing opportunities via the private banking sector are extremely tight. To unlock private sector aloofness, EIB has been rediscovered and put into focus by European politicians as a tool for economic stimulus,” the Barclays report said, “with which private sector involvement can be leveraged.

“In this respect, the European Commission also previously proposed the creation of so-called ‘project bonds’ for infrastructure investment, which would be a new tool to access private funding.”

However, the European Union already has in the European Investment Bank an institution that by definition addresses these considerations and benefits from being already well-established and enjoying a diversified investor base and integration in capital markets. According to the report,

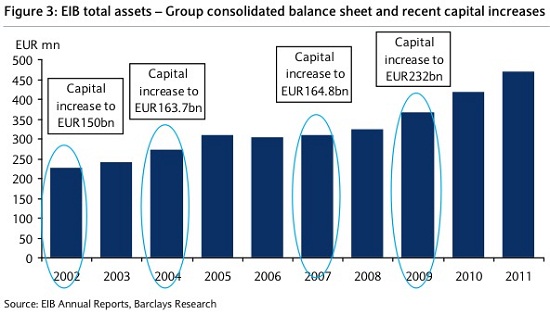

“A capital boost for the EIB would allow for an investment push in Europe. We believe the decision for a capital increase could have a positive effect on investors’ perception of the European situation, as it would strengthen impressions on European cohesiveness and provide the additional funds necessary for economic stimulus.

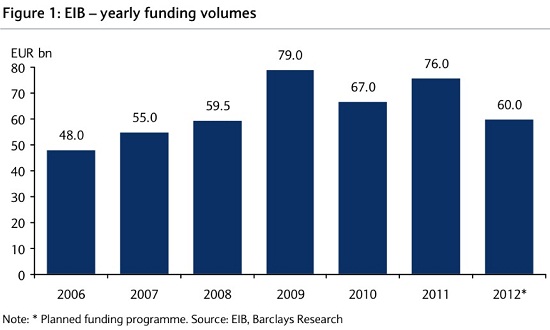

“Given our perception of only a slower increase of lending volumes, in line with the firm risk management of EIB and respectively only gradually increasing funding needs, the spread effect should be more neutral, in our opinion. In addition, EIB’s larger funding requirements in previous years have proven that markets can absorb additional funds.

Barclays experts added that increased boost is increasingly likely, although the decision has to be done on a unanimous basis and smaller countries could be less incentivised to support a capital increase.

“In regard to lending allocations, there could be greater interest from peripheral countries, though commitment from core countries is important and has been shown by some.”

Be the first to comment on "The European Investment Bank could be the answer to austerity exhaustation"