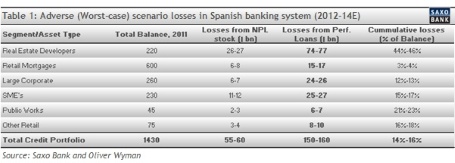

From www.valenciaplaza.com | By Tomas Berggren, equity analysts at Saxo Bank | The result of the independent stress test on Spanish banks calmed the market somewhat. According to the report, the total losses in a worst-case scenario are €250-270 billion with the corresponding capital shortfall being €51-62 billion, i.e. well within what was expected and probably in line with what Madrid wanted to hear.

The losses are still hefty, though, and should be seen from a perspective of the total Spanish lending book that is estimated at €1.5 trillion with total assets of €2.3 trillion. It should furthermore be noted that the capital requirement used to calculate the shortfall in capital is 6 percent, not 9 percent which is currently the target of the European Banking Authority.

It is always tempting and quite easy to criticise the way that these kinds of stress tests are carried out and more importantly interpreted by the market. In this case I believe it is crucial to scrutinise this report since it will lay the foundation for the overall solution in the euro area. I have three main issues with this result and why I think that the situation for Spanish banking is not as “stable” as the auditor communicates or at least as the market interprets.

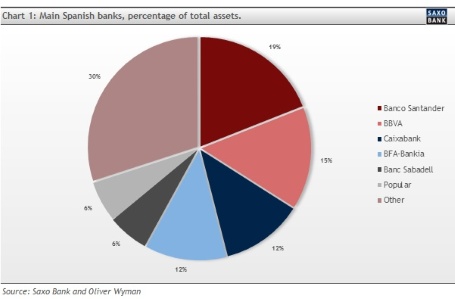

The first issue is the concentration risk meaning that Spain’s three largest banks, Banco Santander, BBVA and Caixabank, accounting for 46 percent of total assets are not expected to need any additional capital.

This is a very “strong result” and a bit surprising given the banks' dominance in the Spanish market. Santander and BBVA have large operations outside Spain that in a worst-case scenario would be negatively affected. This has taken into account the “ceteris Paribus” argument and then a haircut of 30 percent on estimating the profit generation for 2012-14.

The second issue concerns the banks' estimated earnings for 2012-14, stated at €64-68 billion, making up a large chunk (25%) of the overall capital coverage in the worst-case scenario.

how to use facetime on my ipad class=”aligncenter size-full wp-image-11115″ title=”” src=”http://www.thecorner.eu/wp-content/uploads/2012/06/lkj2.jpg” alt=”” width=”455″ height=”250″ />

My fear is that this underestimates the contagion effects playing in when/if credit quality goes from bad to worse. Interest margins and fee income are much more elastic than the operating cost of banks in this kind of environment. Another risk is funding costs going forward, which is hard to predict but should be under pressure if deposits keep leaving Spain.

Although I consider the overall macroeconomic assumptions to be reasonable with a total drop in housing prices of 50-60 percent, in line with the “Irish scenario”, it is more the indirect effect of the worst-case scenario that caught my attention.

The third issue is the low level of losses expected on retail mortgage books, as these are at levels seen in “normal economic times”. Again, the contagion effect of high and increasing unemployment rates will send losses higher. The estimates for retail mortgages are 3-4 percent cumulative for 2012-14.

The argument, according to the low retail mortgage book losses under the worst-case scenario in the report, is that Loan-to-Value is relatively low at 62 percent compared to other countries with similar experiences. If realised losses on the retail mortgage book are in the range of 3-4 percent of total loan value that would be a miracle in itself as Spain's negative economic backdrop could cause credit risk migration. (Spain currently has an unemployment rate of 25 percent which according to the worst case scenario in the report is expected to reach 27.2 percent by the end of 2014.)

Overall, based on this report the Spanish government has bought some more time and the market bought the overall story. This will be further scrutinised as we go along and new facts emerge. For now, though, I am concerned that this stress test will have the same impact as the previous one carried out by the European Banking Authority, i.e. it is not deemed as providing the full picture.