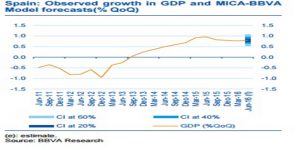

BBVA Research | The trend in the variables observed indicates that the recovery of the Spanish economy continued during the first half of 2016. With nearly 80% of the information available for 2Q16, the MICABBVA model estimates that quarterly GDP growth (QoQ) will have completed one year at around 0.8%. If confirmed, this stabilisation in the pace of expansion would give an upward bias to the growth envisaged in BBVA-Research’s baseline scenario for 2016 (2.7%).

Spain Unite

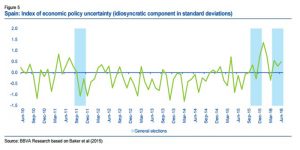

Looking ahead, the recovery of the Spanish economy will continue, despite the high level of uncertainty. On the domestic front, BBVA Research’s estimates suggest that, although demand held firm, economic policy uncertainty continued high until the end of the first half-year, and this could knock 0.3 pp off GDP growth for 2016 and 0.6 pp off that of 2017 relative to a scenario without that uncertainty. Turning to the external scene, the result of the UK referendum on whether to leave the European Union took centre stage, increasing the fragility of the recovery. BBVA Research estimates that the increased economic uncertainty and the volatility seen in the financial markets since the UK referendum result was announced could cost the Spanish economy between three and four tenths of a percentage point of the GDP growth forecast for 2017 (2,7%).

Private demand continues to lead the recovery while exports return to positive territory

The information available for the second quarter of 2016 suggests that domestic demand continues to be the main factor underpinning activity, while external demand has again started to make a practically zero contribution to growth. Private domestic demand, and in particular consumption are still showing no clear signs of weakening in reaction to the climate of uncertainty. This is suggested by trends both in indicators of household expenditure and expectations (new car registrations, retail business and consumer confidence) and in the labour market, which point to similar growth in consumption to that seen in the first three months of the year. Partial indicators of investment in plant and equipment (industry confidence, production and exports of capital goods) suggest that the pace of growth has quickened relative to 1Q2016, although remaining below the one seen throughout 2015. Lastly, residential investment indicators continue to show signs of the sector’s recovery, following the uptick in the first quarter, once again showing growth rates close to those of the second half of 2015.

As for external demand, the expenditure indicators (balance of trade and exports of major corporates) signal that sales recovered across the board in 2Q2016. Thus we expect clearly positive figures, following a first quarter in which good exports stagnated and those of services (in particular, nontourism) fell unexpectedly. As regards the indicators related to tourism, arrivals and foreign tourists’ spending also allow us to anticipate an advance in exports of tourist services in 2Q2016.

The public deficit has not been reduced from 2015

Data available for 1H2016 confirm the slightly expansive context of fiscal policy. Thus adjustments to the public deficit continue to rely on cyclical recovery and low interest rates. In this regard, budget execution data to April show that the public sector deficit (excluding local government) stood at around 0.8% of GDP, just under one tenth of a percentage point above that of one year ago. The data for May indicate that the State recorded a deficit of 2% of GDP, one tenth of a pp better than the deficit observed up to the same month of 2015. In this context, the probability of budgetary targets being missed again this year remains high.

The recovery of the labour market gained traction in 2Q16

New Social Security registrations surprised positively in June (70,000 MoM SWDA according to BBVA Research estimates). Thus the number of people registered with the Social Security at the end of the second quarter was up by 0.9% QoQ swda (0.8% in 1Q2016). In consonance with the foregoing, hiring increased by 0.3pp to 2.3% QoQ swda, both fixed term (2.0% QoQ) and indefinite contracts (5.4% QoQ). At the same time the unemployment maintained its downward trend in June (-45,000 persons SWDA according to BBVA Research estimates), ending the second quarter with a slightly bigger decline in registered unemployment than that seen in the first three months of the year (-2.4% QoQ swda as against -2.3% in 1Q2016).

Energy exerted less downward pressure on inflation

The leading indicator noted that consumer prices continued to fall in June (-0.8% YoY), albeit at a slightly slower pace than in the previous month (-1.0% YoY). In this regard, BBVA Research estimates suggest that energy is the only component that contributes negatively to inflation, while core inflation remains positive (at around 0.7%). However, these developments in consumer prices continue to take place in an environment of low and stable inflation in Europe, and consequently limit the gains in price competitiveness of the Spanish economy. Thus, although it remains favourable, the differential in trend inflation relative to the euro zone fell by 0.4 pp over the course of the past year to -0.2 pp in May.

The Spanish economy maintains its financing capacity

At the end of the first quarter, the financing capacity of the Spanish economy held at 2.1% of GDP on an annual cumulative basis, the same level as at the end of 2015. This was the result of an increase in the rate of savings (to 22.3% of GDP) similar to that in the rate of investment (to 20.9%). Patterns of behaviour among different economic agents were uneven in 1Q2016: whereas financial institutions and businesses improved their financing capacity, households reduced theirs. On the other hand, government authorities held their negative balances steady.

Balance of payment data for April indicate that, from the point of view of the financial account, the Spanish economy increased its financing capacity to €34.8 billion in the twelve month aggregate (€63.5 billion if Banco de España is excluded). Looking ahead, we expect the Spanish economy to continue to show financing capacity relative to the rest of the world, given its structural adjustments, the expected growth in exports, the favourable financing conditions and the cumulative decrease in the price of oil.

*Image: Flickr