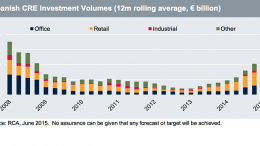

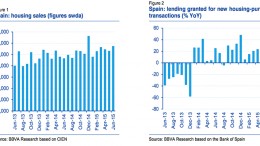

Spain Is The World’s 6th Largest Property Investment Market

It’s not really surprising that Spain’s real estate market has become one of the most attractive in the world, given that property prices are still only slowly recovering from an almost 40 percent decline at the height of the crisis, and the country’s economy is now back on the path to growth.