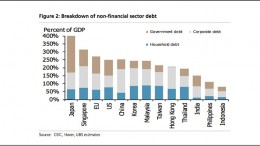

It’s all about supply and demand

BoAML | According to Summers, the main source of weak US and global growth is insufficient aggregate demand. The equilibrium funds rate has dropped sharply so super aggressive monetary policy and asset bubbles are needed to create full employment and normal inflation. By contrast, we have argued that most of the stagnation is coming from the supply side of the economy.