Why The Latest China’s Infrastructure Investment Drive Is Not Another Stimulus

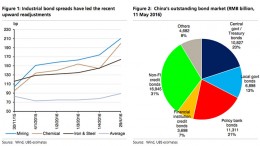

Zhu Haibin via Caixin | A recent government plan to invest 4.7 trillion yuan in over 300 infrastructure projects from 2016 to 2018 received wide attention and raised questions about whether this was another massive stimulus similar to the one rolled out in 2008 in the aftermath of the global financial crisis.