Spanish Banks Likely to Avoid the “Swiss rate” scenario

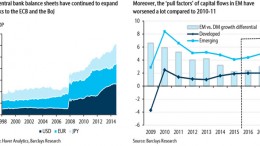

UBS | President Draghi surprised the market positively, both in terms of the magnitude of some of the expected moves (QE extension in the upper end of the range) and also implementing new measures (acquisition of non-financial IG bonds in its asset purchases, and new targeted TLTRO). For (retail) banks like the Spanish, the balance of ECB’s actions has to be considered as positive, especially if trends seen in the swap market are confirmed in Euribor fixings.