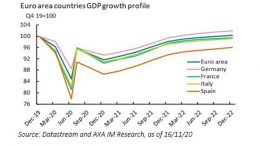

Apolline Menut (AXA IM) | For Eurozone economies, 2020 cannot end soon enough. After a 15.1% decline in the first half of the year and a strong, but partial, rebound in the Q3, the euro area economy is set to contract again in Q4 (-4.1%qoq). The autumn lockdowns triggered by the pandemic’s second wave are less restrictive than in the spring (schools, the public sector and industry remain open this time), and so is our assumption of activity hit (-10% in November on average for the euro area versus around -25% in April). But the euro area will finish the year 8.3 percentage points (ppt) below end-2019 levels and with large dispersion across countries. Virus developments, stringency of restrictions, exposures to the most affected sectors (Exhibit 1) and fiscal supports vary across countries. For that reason, we see German growth shrinking by “only” 6%yoy in 2020, half of the contraction we expect in Spain, and much better than the 7.7% decline we project for the euro area as a whole.