Inflation Expectations Not Yet Decoupled From The Official ECB

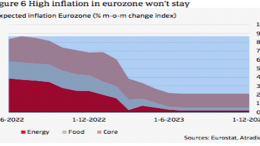

Crédito y Caución (Atradius) | High inflation is the current hot economic topic. In June, inflation was running at over 11% in the Netherlands1; for the eurozone it was nearly 9%, which is surely a record. It is also sure that the inflationary bite is being felt, particularly in the purchasing power of lower income groups. The question is, how long will this high inflation last? In recent months, energy…