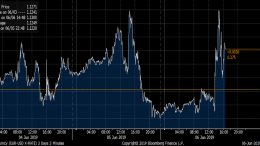

Whatever it takes, once again

“There is no probability of deflation, there is very low probability of recession, there are no threats of de-anchoring of inflation expectations,” Mario Draghi said on Thursday. The governor of the European Central Bank announced once again – as he did in March – that it will delay the rate hike at least until 2020 and kept all options open, especially in case economic prospects deteriorate. ECB’s decision is in line with those of other central banks in the world. The Fed has just opened the door to a rate cut, something that Australia and India have already done.