The Flaws In Spanish Public Debt Figures

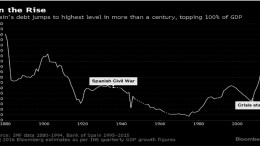

It has been revealed this week that Spain’s public debt has exceeded 100% of GDP for the first time, reaching 1.095 billion euros. According to the Bank of Spain, this figure represents about 101% of GDP. Almost at the same time, Bloomberg published a graph showing that this level had not been seen since 1909, as well as the level of debt during the Spanish Civil War. With just one month to go to new elections in Spain is this graph oportunistic?