Spanish Treasury Proposes €75 Bn Net Issuance By 2022, A Level Similar To That Of 2021

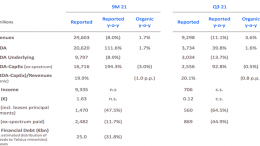

Bankinter | The Treasury announced on Monday its Financing Strategy for 2022. The Treasury ended 2021 with total Gross issuance of €264.312 billion and Net issuance of €75.138 billion, -25% below the proposed target and -31.6% below 2020 net issuance. The average cost of debt issued amounted to -0.04% and that of outstanding debt stood at 1.64% (from 1.86% at the end of 2020).