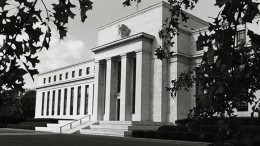

The Fed Should Print Trailers

Benjamin Cole via Historinhas | Thanks to the extraordinary insights of blogger Kevin Erdmann, the issue of US housing costs and inflation has been brought into better focus. Erdmann recently brought up manufactured housing, or house-trailers, a wonderful topic.